Schoellerbank: Excellence in asset management since 1833

For over 190 years, Schoellerbank has embodied the perfect balance between tradition and innovation in Austrian banking. Our philosophy of "invest rather than speculate" is the foundation of our approach to achieving sustainable asset development and long-term success for our clients.

As one of Austria's leading private banks, we specialise in three core areas:

- investment advice

- asset management

- and wealth planning.

As a wholly owned subsidiary of UniCredit Bank Austria, we have become UniCredit's centre of excellence for wealth management in Austria, offering the exclusive service of a private bank alongside the reliability of an international banking network.

Key figures

287

Employees

7.85 bn Eur

Schoellerbank Invest AG

fund assets under management

(12/2025)

13.74 bn EUR

Client assets under management/TFA

(12/2025)

78.53 %

Common Equity as per Basel III

(12/2024)

Would you like to know who is behind Schoellerbank?

Information about our Management Board, Supervisory Board and advisory teams can be found on our "Management" page.

The history of Schoellerbank: Tradition as a commitment

We have supported clients in making investment decisions for over 190 years. Through the development of careful investment strategies and the continuous refinement of our business processes, we have established ourselves as a leading provider of asset management services.

Our path to success has been marked by pioneering decisions and continuous development. As part of UniCredit Bank Austria and the UniCredit Group, we also benefit from a strong international network without compromising our identity as an exclusive private bank.

The history of Schoellerbank:

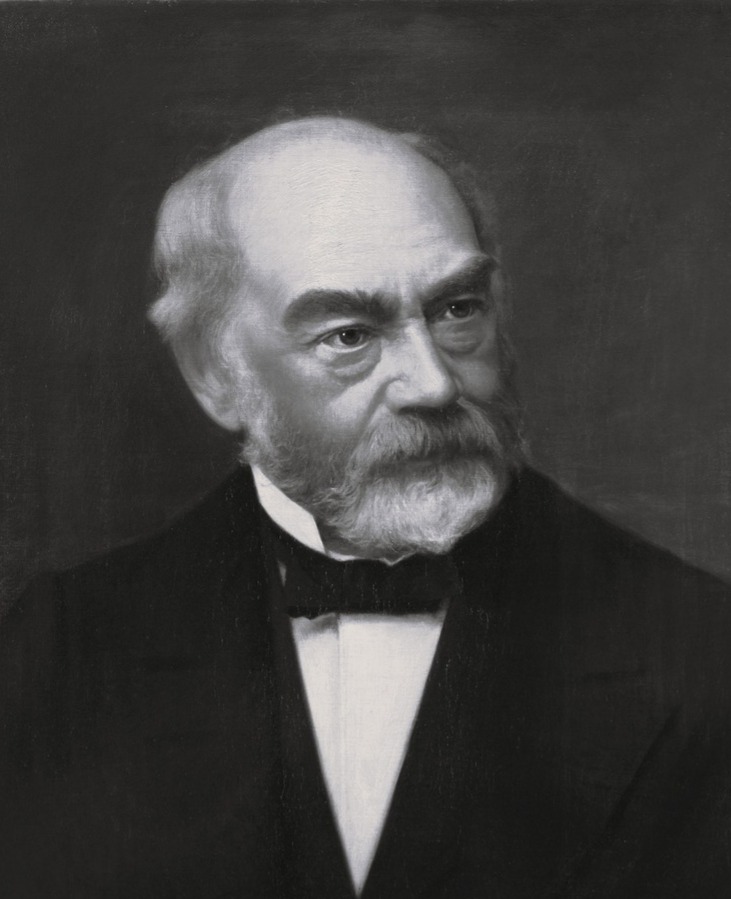

1833

Alexander Schoeller founds the "Bank- und Großhandelshaus Schoeller" on 20 July 1833.

1863

Alexander Schoeller is knighted by Emperor Franz Joseph I.

1979

Schoeller & Co is converted into a public limited company.

1992

Bayrische Vereinsbank acquires Schoellerbank and opens Schoellerbank Vermögensverwaltung on 31 December.

1994

The in-house fund company Schoellerbank Invest is founded.

1998

Schoellerbank merges with Salzburger Kredit- und Wechselbank (SKWB).

2003

The decision has been made to revert to the company name "Schoellerbank AG".

2005

The Italian banking group UniCredit acquired the German HypoVereinsbank, thereby also acquiring Bank Austria Creditanstalt and its subsidiary Schoellerbank.

2023

Schoellerbank celebrates its 190th anniversary in its anniversary year. Schoellerbank Vermögensverwaltung also celebrates its 30th anniversary this year.

2024

Schoellerbank becomes UniCredit's centre of excellence for wealth management in Austria.

Our values: The foundation for cross-generational success

Tradition means taking responsibility. Long-term customer relationships are founded on trust and clear values. We understand that our customers expect more from us than just financial expertise. Most of them are looking for a long-term financial partnership based on trust and honesty.

Many of our customers have entrusted us with their assets for generations, which is proof of the sustainability of our philosophy and values.

Our investment philosophy

Our priority is preserving assets through a well-thought-out, long-term, responsible strategy.

We avoid speculative approaches that deliver short-term results. Sustainable value growth can only be achieved if an investment is given sufficient time to develop.

This philosophy is reflected in our investment products investment products, which focus on "invest rather than speculate".

Focusing on your needs

Experience has taught us that personalisation is the key to satisfaction in asset management.

Anti-cyclical behaviour

Rather than blindly following financial market trends, we rely on prudent, countercyclical action.

Rather than blindly following financial market trends, we rely on prudent, countercyclical action.

This approach frequently reveals unique investment opportunities for our clients that lie outside the mainstream.

Our awards

Our investment strategy and advisory services are consistently recognised by independent experts. These accolades confirm the high quality of our services, our innovative asset management concepts, and our commitment to sustainable investments.

They also encourage us to continue on our successful path.

Overview of our awards (only available in German)